Payment returns

Returning an incoming payment, this service in the Client Portal enables you to initiate a return of an incoming payment directly from your transaction list. For example, if you receive a duplicate payment from a customer or partner, you can quickly initiate a return directly from your transaction list. This process is efficient and ensures all necessary checks and approvals are maintained.

All users with Initiate payments permissions can also return incoming or own payments.

Key points and limitations:

- Initiation of return payments are subject to the same limitations as initiating an outgoing payment. Please see Initiate Payments

- Return payments follow the same pricing as outgoing transactions, with the Charge Bearer set to "SHA" (shared charges)

- Return payments requiring a purpose code for mainland China are not supported

- Agency Banking & Corresponding Banking payments are not supported

- A payment cannot be returned if it has already been returned, of if a return request is currently in progress

- Support for local payments may vary depending on the payment type

- If the Creditor Name exceeds 35 characters, it will be truncated, and unsupported symbols may be converted to prevent rejections

- Second return attempts are not supported. If a return is cancelled, any new return must be completed by instructing an outgoing payment - see Initiate Payments

Returning a payment

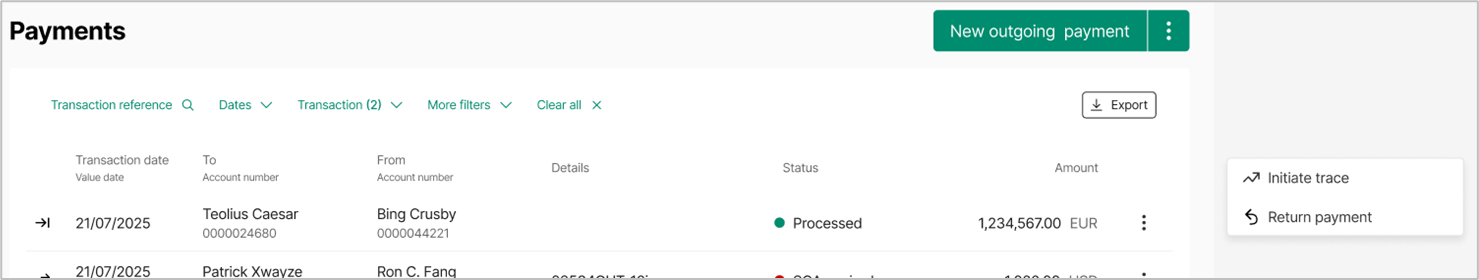

Step 1:

- Log in to the Client Portal.

- Navigate to Transactions then Payments.

- Find the payment you wish to return in the transaction list.

- Click the three-dots menu and click the Return payment option.

- Note: This option is available only for Incoming or Own payments that have been processed.

Three-dots menu

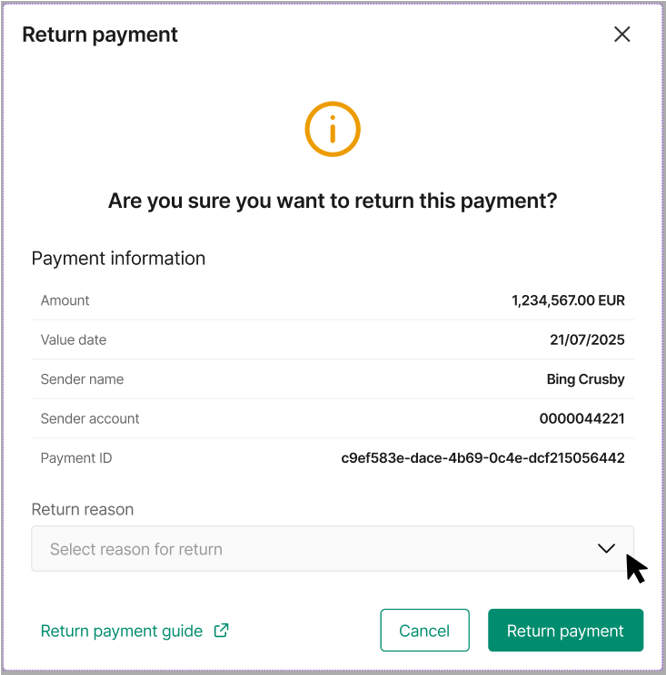

Step 2:

- A modal will appear showing payment details, including sender, amount, and value date.

- Select the appropriate Return reason from the dropdown (e.g., Duplicate payment, Remitter’s request).

- Click Return payment to continue.

Confirm payment return

Note:

- A return payment cannot be made if the payment has already been returned, if a return request is in progress, or if more than 30 days have passed since the payment was received.

- Second tries are not supported. If a client cancels a return and later tries again, a message will appear stating that a return has already been attempted. In this case, the return must be completed by creating an outgoing payment.

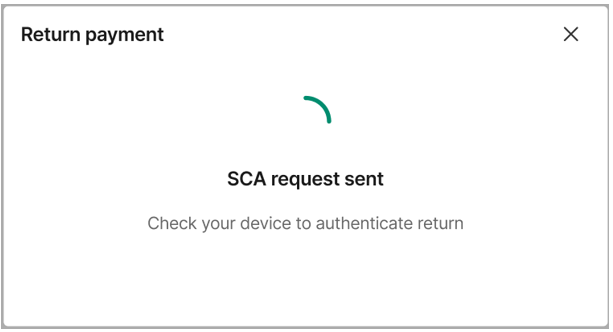

Step 3:

- For security, you’ll be prompted for Strong Customer Authentication (SCA).

- Approve the request using your Authy Twillio app.

Strong Customer Authentication

Success message

Step 4:

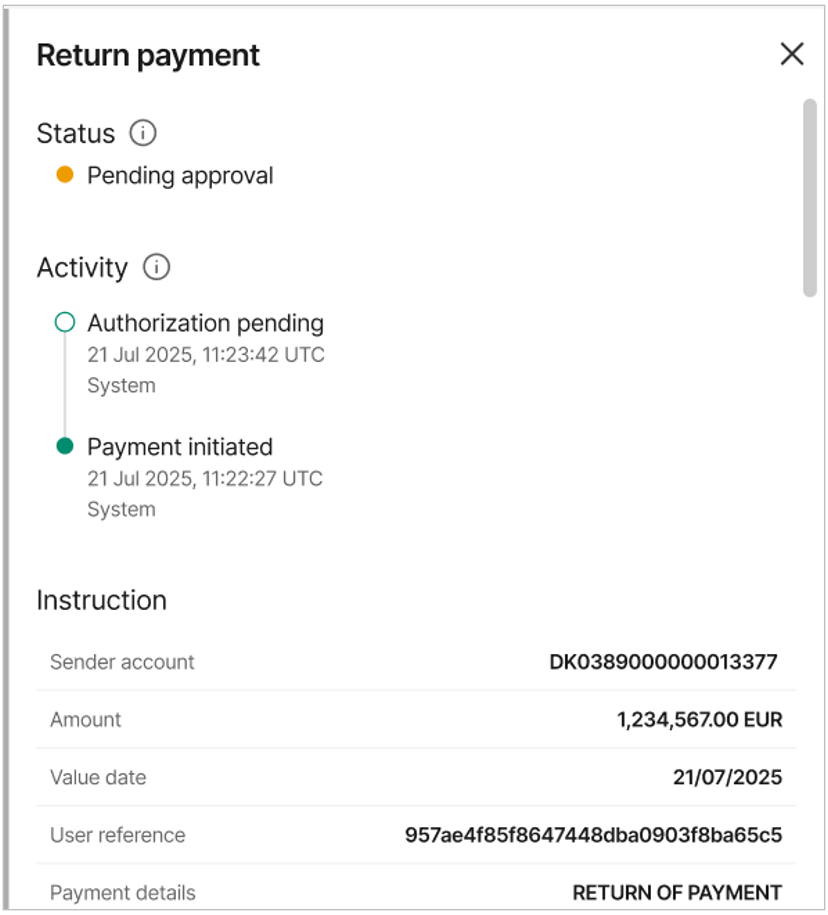

- Approval workflow, if additional approvals are required within your organisation, the return will appear in the Client Portal dashboard as a Return payment.

- The transaction will be flagged as a Return in the details drawer for easy identification.

Payment detail drawer view

Step 5:

- Once all approvals are completed, the returned payment will be processed.

- You’ll see the payment marked as Return of Payment in the transaction list.

- Payment status (e.g., "Pending", "Processed") help you monitor progress, returns are processed as outgoing payments.

Updated about 1 month ago